Introduction

Most small business owners work hard every day—but many don’t actually know if their business is truly profitable. Money comes in, bills go out, and what’s left feels like “profit,” but that’s often a dangerous assumption.

The Profit and Loss Statement (P&L) cuts through the noise. It shows, in plain numbers, whether your business is making money or quietly bleeding cash. When your P&L is accurate and up to date, you stop guessing and start managing with confidence.

If you want financial clarity, stability, and real growth—not surprises—this report is non-negotiable. Understanding it is one of the smartest business habits you can build.

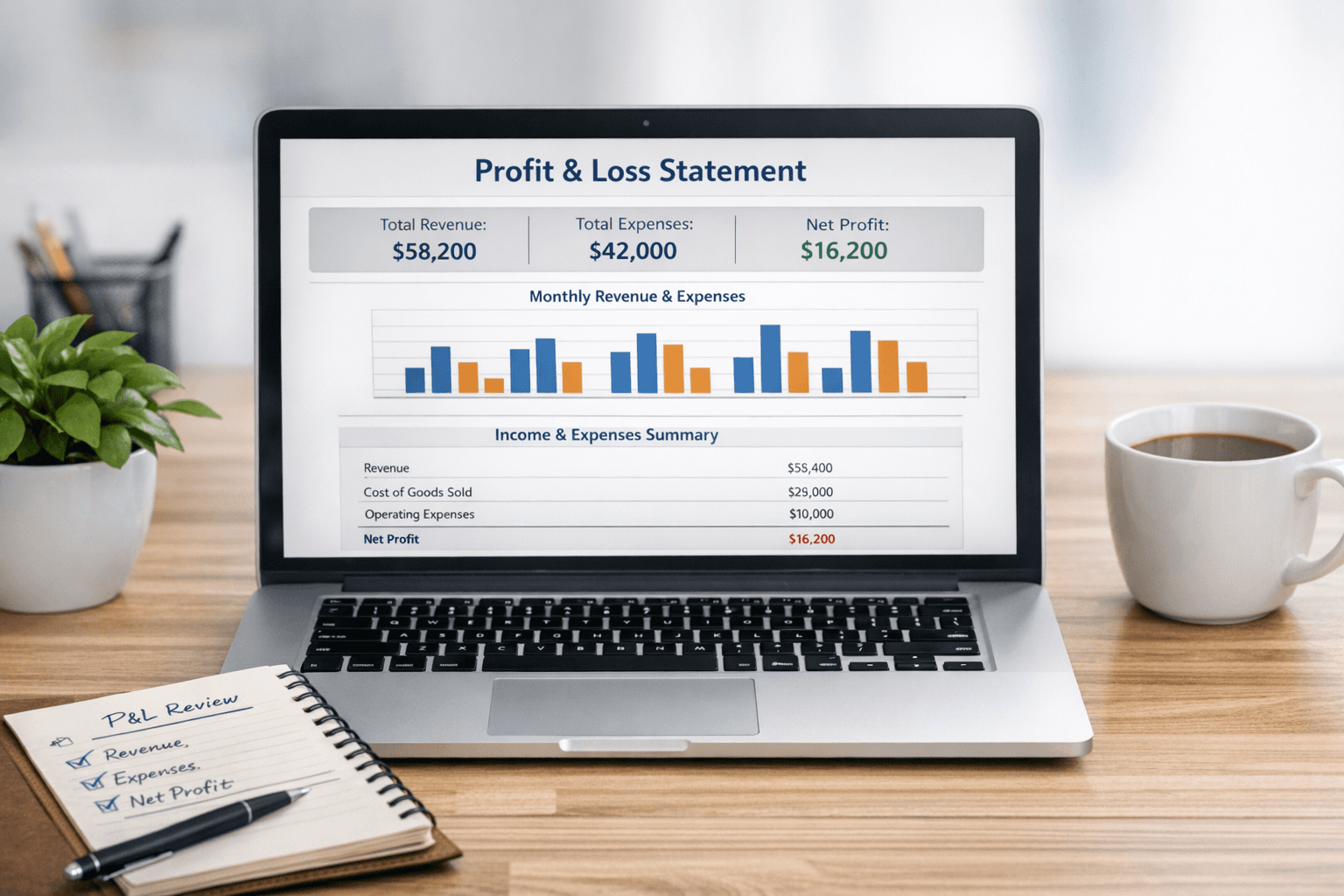

1. What a Profit and Loss Statement Actually Is

A Profit and Loss Statement summarizes your income, expenses, and net profit over a specific period—usually monthly, quarterly, or annually. It answers one critical question: Did my business make or lose money during this time?

Unlike a bank balance, the P&L reflects real business performance. It shows trends, problem areas, and opportunities long before they become emergencies.

2. Why the P&L Is More Important Than Your Bank Balance

Your bank account tells you how much cash you have today—not whether your business model works. A strong balance can hide serious issues like underpricing, rising costs, or shrinking margins.

The P&L shows the full financial picture. It reveals whether your operations are sustainable and where adjustments are needed before problems compound.

3. How the P&L Helps You Control Expenses

Most expense leaks don’t come from big purchases—they come from small, repeated costs that go unnoticed. Without a P&L, these quietly eat into profit.

A well-organized P&L highlights expense patterns so you can make smart cuts without harming growth. Control comes from visibility, not guesswork.

4. Using the P&L to Make Better Business Decisions

Should you hire? Raise prices? Invest in marketing? The P&L gives you data-backed answers instead of gut feelings.

When reviewed consistently, it becomes a decision-making tool—not just a report for your accountant. That’s where confident leadership starts.

5. Why Lenders, Investors, and CPAs Rely on It

Banks, investors, and tax professionals don’t want stories—they want numbers. The P&L shows profitability, consistency, and risk.

Clean, accurate reports build credibility. Messy or missing P&Ls raise red flags and can delay financing, partnerships, or tax filings.

6. Common Mistakes Business Owners Make With P&Ls

Many owners only look at their P&L once a year—or only during tax season. By then, it’s too late to fix what went wrong.

Others rely on inaccurate books, mixing personal and business expenses or skipping reconciliations. A flawed P&L is worse than none at all.

7. How Professional Bookkeeping Makes the P&L Powerful

A Profit and Loss Statement is only as good as the data behind it. Professional bookkeeping ensures income and expenses are categorized correctly and consistently.

When your books are clean, your P&L becomes a strategic asset—one that supports growth, planning, and peace of mind.

Conclusion

The Profit and Loss Statement isn’t just a report—it’s a reality check. When reviewed monthly and backed by accurate bookkeeping, it gives you control, clarity, and confidence. If you want to grow your business responsibly, start by understanding your P&L.

Related Reads for You

Discover more articles that align with your interests and keep exploring.