QuickBooks Online automation promises to save you hours every week. But here's the hard truth: most small business owners are unknowingly creating costly errors through poorly configured automation settings.

I've seen many business owners who think they're being efficient by "setting it and forgetting it," only to discover months later that their books are riddled with duplicate transactions, misclassified expenses, and missing income. The cleanup costs alone can run into thousands of dollars: not to mention the stress during tax season.

If you're like most small business owners, you probably set up QuickBooks automation once and never looked back. That single decision could be costing you more than you realize.

Mistake #1: Trusting Automatic Matching Without Verification

QuickBooks automatically matches bank feed transactions to manually entered transactions based on check numbers, amounts, dates, and payees. Sounds helpful, right? The problem is that this automation frequently makes incorrect matches, leading to duplicate transactions, miscategorized entries, and inaccurate financial reporting.

Here's what typically happens: You manually enter a $500 vendor payment on Monday. On Wednesday, your bank feed imports the same $500 transaction. QuickBooks "helpfully" matches them together, but now your expense appears twice in different categories.

How to fix it:

Always verify automatic matches before accepting them

Review matched transactions in the Categorized or Reviewed tab to ensure accuracy

If automatic matching creates more problems than solutions, turn off the Auto-match feature

Manually match deposits to invoices for better control and accuracy

Pro Tip: Spend 10 minutes each week reviewing your matched transactions. This small time investment prevents hours of cleanup work later.

Mistake #2: Setting Up Bank Rules That Work Against You

Bank rules are designed to automatically categorize transactions, but when configured incorrectly, they create systematic errors across every transaction they process. One bad rule can misclassify hundreds of transactions before you notice.

I've seen business owners create overly broad rules that catch unintended transactions. For example, a rule that categorizes all "Amazon" transactions as "Office Supplies" will also miscategorize your Amazon Web Services hosting fees as supplies instead of technology expenses.

How to fix it:

Define your accounting structure clearly before creating any rules

Test new rules on a small batch of transactions first

Review and update rules quarterly to ensure they align with current operations

Delete rules that cause more problems than they solve

Quick Tip: Create specific, narrow rules rather than broad ones. It's better to have more precise rules than fewer problematic ones.

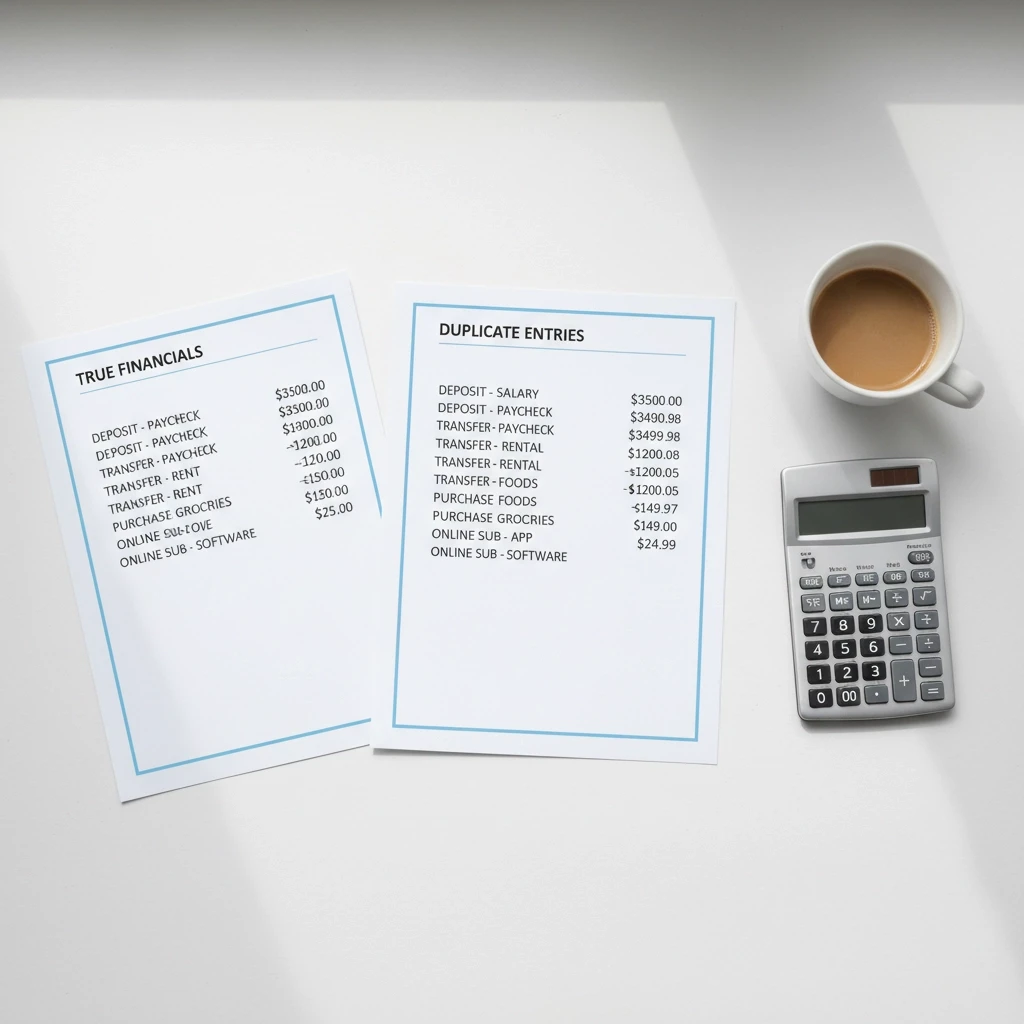

Mistake #3: Overlooking Duplicate Imports and Hidden Transactions

When bank feeds sync automatically, duplicate transactions become inevitable: especially when you're manually entering transactions while the bank feed simultaneously imports the same data. This problem compounds when you're using multiple sales channels or payment processors.

The most dangerous part? These duplicates often hide in different categories or accounts, making them difficult to spot during casual reviews.

How to fix it:

Reconcile bank accounts regularly to catch duplicates early

Link all financial institutions to QuickBooks to reduce manual entry opportunities

Implement real-time inventory syncing tools instead of manual adjustments

Create a monthly duplicate-checking routine using QuickBooks' search functions

Pro Tip: If you sell across multiple channels (Shopify, Amazon, POS systems), invest in integration tools that prevent duplicate entries rather than trying to catch them after the fact.

Mistake #4: Misclassifying Transactions Through Automated Categorization

Automation systems often assign transactions to the wrong categories, creating a domino effect that distorts your financial reports. This becomes especially problematic with credit card feeds, where account limitations make proper categorization nearly impossible.

Consider this scenario: Your monthly software subscription gets automatically categorized as "Office Supplies" instead of "Technology Expenses." Over time, this makes your office supply costs appear inflated while understating your actual technology investments.

How to fix it:

Customize your Chart of Accounts to reflect your specific industry and operations

Create clear, distinct account names that automation can accurately match

Review categorization reports monthly to identify misclassification patterns

Use descriptive account names that both automation and humans can understand

Quick Tip: Avoid generic account names like "Miscellaneous Expenses" that become catch-alls for automation errors.

Mistake #5: Using Wrong Offset Accounts in Inventory Adjustments

When automating inventory adjustments, posting to the wrong offset account distorts both your balance sheet and profit & loss statement. This makes your business appear more profitable than it actually is: a dangerous illusion that can lead to poor financial decisions.

Here's the error: When you discover $5,000 worth of damaged inventory, the adjustment should reduce your Cost of Goods Sold or an expense account, not your Inventory Asset account. Getting this wrong inflates your asset values and understates your true costs.

How to fix it:

Always verify that inventory adjustments post to the correct offset account

Document every adjustment with clear memos and backup information

Implement audit trails to track what changed, when, and why

Review inventory adjustment reports monthly for accuracy

Pro Tip: Create standard operating procedures for inventory adjustments to ensure consistency, especially if multiple team members handle inventory.

Mistake #6: Ignoring Default Settings That Don't Match Your Business

QuickBooks Online defaults control how income and expenses are categorized, your accounting method, fiscal year, and sales tax application. Leaving these defaults in place when they don't match your actual business structure creates cascading errors that compound over time.

Most business owners rush through the initial setup, accepting default settings without understanding their implications. These seemingly minor choices affect every automated transaction that follows.

How to fix it:

Spend time configuring default settings during initial setup

Customize payment terms, invoice templates, and automation features for your business

Review default categories and modify them to match your industry

Consult with an accountant if you're unsure about proper settings

Quick Tip: Don't go live with QuickBooks until you've verified that all default settings align with your business operations.

Mistake #7: Blindly Trusting Automation Without Regular Audits

The most dangerous mistake is assuming that QuickBooks automation eliminates the need for human oversight. Missing transactions, duplicate imports, and misclassifications can lead to serious reporting errors, inflated tax bills, and countless hours of cleanup work.

Automation should enhance accuracy, not replace accountability. Business owners who never review their automated processes often discover problems only during tax preparation: when fixing errors becomes exponentially more expensive.

How to fix it:

Establish monthly audit routines to review key reports and reconcile accounts

Manually spot-check transaction categorizations and verify bank feed completeness

Keep detailed records of manual adjustments and audit trails

Consider working with a bookkeeping professional who can review your automation setup

Pro Tip: Schedule a recurring monthly appointment with yourself to review your books. Treat this as seriously as any other business meeting.

The Real Cost of Automation Mistakes

Here's what business owners don't realize: the cost of fixing automation errors: in terms of inaccurate financial reports, tax complications, and staff time: far exceeds the time saved by poorly configured automation.

When automation works correctly, it's incredibly valuable. When it doesn't, it creates problems that multiply silently in the background until they explode during tax season or financial reviews.

Your Next Steps

QuickBooks automation works best when combined with proper setup, verification, and ongoing oversight. Don't let these common mistakes turn your time-saving tool into a costly problem.

Start by auditing your current automation settings. Check your bank rules, review recent matched transactions, and verify that your default settings align with your business needs. Then, implement a monthly review routine to catch issues before they become expensive problems.

Remember: automation should serve your business, not control it. With the right setup and regular oversight, QuickBooks can truly save you time while maintaining accuracy: but only if you avoid these seven critical mistakes.

Related Reads for You

Discover more articles that align with your interests and keep exploring.