Introduction

Many small business owners assume their accountant is “handling the books.” After all, you send documents at tax time, you pay a professional fee, and everything feels covered. But in reality, bookkeeping and accounting are not the same service—and assuming they are can cost you clarity, control, and money.

When bookkeeping is neglected or treated as an afterthought, financial reports become unreliable. Decisions are made based on incomplete data. Tax season becomes reactive instead of strategic. The result? Stress, missed deductions, and limited financial insight throughout the year.

Understanding who does what—and when—puts you back in control. Clear, consistent bookkeeping creates stability. Strategic accounting builds on that foundation. When both roles are handled properly, your business gains financial clarity, stronger cash flow awareness, and smarter long-term growth decisions.

1. Bookkeeping and Accounting Are Not the Same Thing

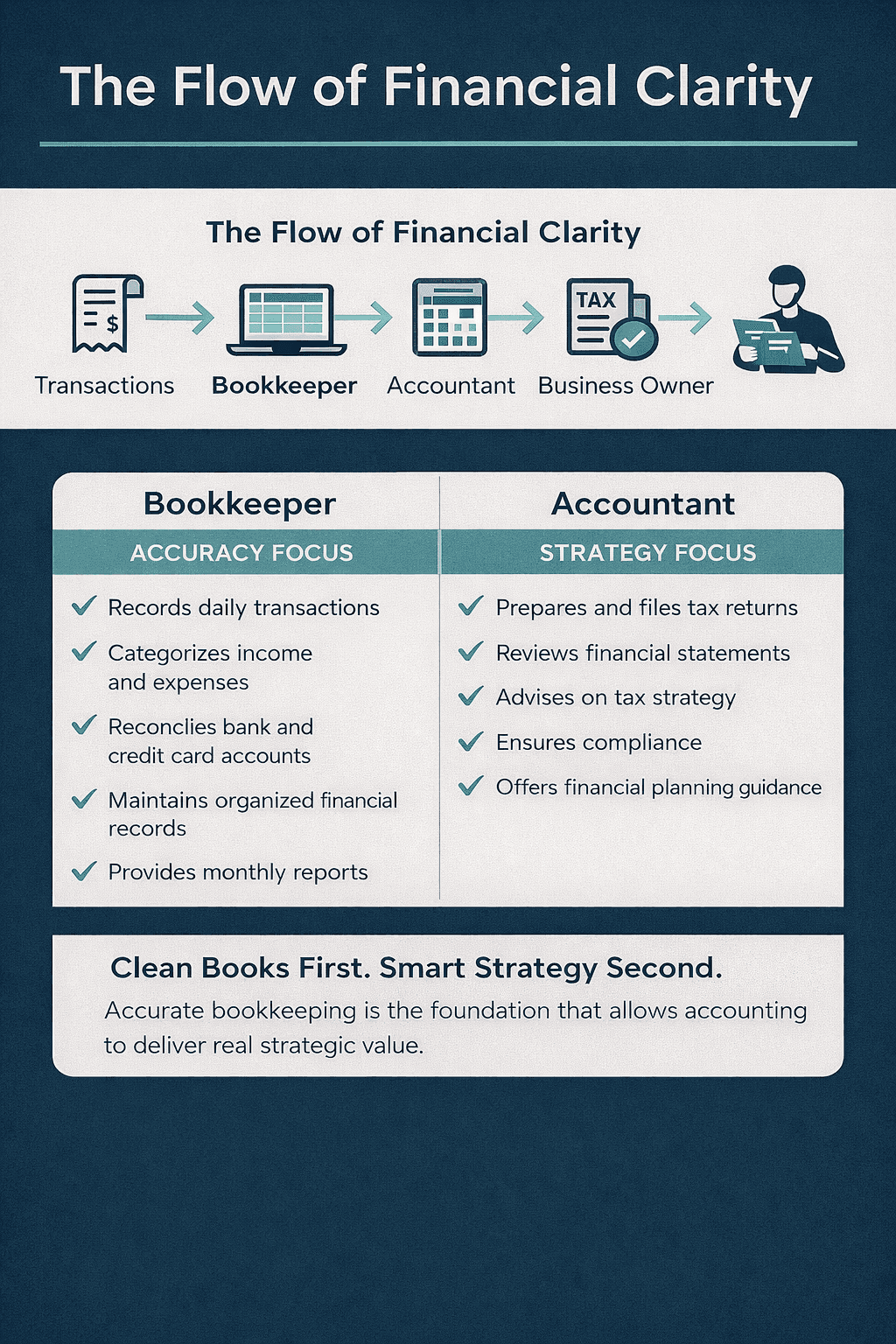

Bookkeeping is the ongoing process of recording, categorizing, and reconciling your daily financial transactions. It ensures your income, expenses, assets, and liabilities are tracked accurately and consistently throughout the year.

Accounting uses that organized data to prepare tax returns, analyze financial performance, and provide strategic advice. Accounting depends on bookkeeping. Without clean books, even the best accountant is working with incomplete information.

2. What Most Accountants Actually Do

Most accountants focus on compliance and tax preparation. They review your numbers periodically—often quarterly or annually—and ensure tax filings are accurate and timely.

However, they are typically not entering transactions weekly, reconciling accounts monthly, or cleaning up miscategorized expenses. If bookkeeping is not actively maintained, your accountant may simply work with whatever data is provided.

3. Why Ongoing Bookkeeping Matters More Than You Think

Bookkeeping is not just data entry—it is financial maintenance. Monthly reconciliations prevent errors from snowballing. Proper categorization ensures your reports reflect reality.

Without ongoing bookkeeping, your Profit & Loss statement becomes unreliable. Cash flow issues go unnoticed. Business decisions become guesses instead of informed choices. Clean books remove uncertainty.

4. The Risk of Assuming “It’s Being Handled”

Many business owners assume everything is fine until tax season reveals inconsistencies, missing documentation, or rushed corrections. At that point, fixes become expensive and reactive.

When bookkeeping is ignored during the year, financial clarity disappears. You may overpay taxes, miss deductions, or misjudge profitability. That assumption—“my accountant is handling it”—often leads to avoidable problems.

5. Clean Books Strengthen Tax Strategy

Strategic tax planning only works when numbers are accurate. Accountants can only optimize deductions and structure planning if financial reports reflect true activity.

Accurate bookkeeping allows your accountant to focus on proactive strategy instead of cleanup. That difference can translate into tax savings, better planning, and improved long-term financial positioning.

6. Monthly Bookkeeping Creates Stability

Consistent monthly bookkeeping builds rhythm and discipline into your business. You know where you stand financially at any given time.

This stability improves cash flow management, supports loan applications, strengthens investor confidence, and provides peace of mind. Financial clarity is not accidental—it is built monthly.

7. The Smart Approach: Both Roles Working Together

You do not choose between a bookkeeper and an accountant. You align them. The bookkeeper maintains accurate records. The accountant interprets those records strategically.

When both roles function properly, your business operates with clarity, compliance, and confidence. That combination creates stability today and growth tomorrow.

Conclusion

If you assume your accountant is doing your bookkeeping, it is worth asking a simple question: who is maintaining your books monthly? Bookkeeping creates the foundation. Accounting builds strategy on top of it. When both roles are clearly defined and properly handled, your business gains financial clarity, stronger decision-making, and sustainable growth.

Related Reads for You

Discover more articles that align with your interests and keep exploring.